itimas.ru Recently Added

Recently Added

How Much Are Telehealth Visits

For patients not covered by insurance, self-pay visits are $64 each. Scheduled Telehealth. Scheduled Telehealth gives you the power to choose a date and time. For eVisits, no insurance is billed and there is a flat cost of $ For Urgent Care Video Visits, your insurance will be billed for this visit and collect a co. How much will my telehealth visit cost? It varies. Your telehealth visit may be free or low cost with health insurance, although some insurance plans don't. Benefits of telehealth. If you live far away from a hospital or clinic or it's tough to fit appointments into your busy schedule, video visits can make it. Start a Lee TeleHealth e-Visit Now · How does it work? · What are the benefits? · How much does it cost? · $29 E-visits · Pages in this section · Also of Interest. Of all health care services, virtual visits are often the least expensive for the patient. Contact your health care plan administrator to verify your. Virtual Visits · Why Do a Virtual Visit? · What Types of Virtual Visits are Available to Patients? · How Do I Get Started? · FAQs. Denver Health is now offering virtual / telehealth visits to patients who want extra flexibility when seeing the doctor. Are You Eligible for Discounted. visits – also known as telehealth. It's a way to talk to a health How much and when will I have to pay for a virtual primary care visit? You. For patients not covered by insurance, self-pay visits are $64 each. Scheduled Telehealth. Scheduled Telehealth gives you the power to choose a date and time. For eVisits, no insurance is billed and there is a flat cost of $ For Urgent Care Video Visits, your insurance will be billed for this visit and collect a co. How much will my telehealth visit cost? It varies. Your telehealth visit may be free or low cost with health insurance, although some insurance plans don't. Benefits of telehealth. If you live far away from a hospital or clinic or it's tough to fit appointments into your busy schedule, video visits can make it. Start a Lee TeleHealth e-Visit Now · How does it work? · What are the benefits? · How much does it cost? · $29 E-visits · Pages in this section · Also of Interest. Of all health care services, virtual visits are often the least expensive for the patient. Contact your health care plan administrator to verify your. Virtual Visits · Why Do a Virtual Visit? · What Types of Virtual Visits are Available to Patients? · How Do I Get Started? · FAQs. Denver Health is now offering virtual / telehealth visits to patients who want extra flexibility when seeing the doctor. Are You Eligible for Discounted. visits – also known as telehealth. It's a way to talk to a health How much and when will I have to pay for a virtual primary care visit? You.

A: Telehealth Visits cost the same as in-person office visits. They are billed to insurance and are subject to copayments and deductibles, if applicable. Q: How. If you do not have insurance, your cost is only $79 per visit. If you have insurance, you may pay more or less depending on your plan's benefits and whether or. Telehealth simply means a doctor visit on the phone or via video using a smartphone or computer. You will be able to talk with your provider from the comfort. What are the Benefits of Using Telehealth Online Visits? Doctor On Demand is a covered benefit for over 98 million Americans. If not a covered benefit, prices start at $ Find out more. Visits are $79 (self-pay price if patients choose to pay out of pocket without insurance). Patients with insurance can verify their insurance at the time of. How much does Virtuwell cost? Virtuwell visits are as low as $0 with insurance. Whether you use insurance or not, there are never any hidden fees or extra. Video Visits - How it works. Core Physicians uses Doximity for online video appointments. A few days before your scheduled appointment: You will receive an. Telehealth is usually the same cost as an in-person appointment and e-visits are typically less expensive than an office visit. Virtual care providers. Virtual care, also called telehealth or telemedicine, gives you access to a healthcare provider without having to travel to their office. You can do virtual. For most telehealth services, you'll pay the same amount that you would if you got the services in person. Find out cost. To find out how much your test, item. Virtual Care On Demand. See an urgent care clinician in under 30 minutes without the need to schedule a visit. Cost without insurance $ 3 Current Telemedicine Technology Could Mean Big Savings, Health they compared the utilization of telehealth services to office visits and emergency room. Affordable Price $59 per visit. No appointments Need. Book Televisit. Get care 24/7/. We also offer self-pay pricing for $75 for a virtual visit. If you have questions about insurance or billing, please reach out to your nearest CareNow® location. Teladoc and MDLive telehealth program costs · PPO Members: Copay is $15 · CDHP Members: You pay the negotiated rate per visit until you reach your deductible. A telehealth visit is the same cost as your standard office visit co-pay. If you prefer or need to talk to your provider by phone, this is an option as well. Virtual Care & Telehealth Visits. Making it easy to access quality care How much does a video visit with my provider cost? Insurance coverage of. A virtual visit is $59 without insurance, payable at time of your visit via credit card. If you have insurance, check with your provider or use the app to see a. You can also choose to schedule virtual video visits with your doctors who offer them. Many EmblemHealth plans also include a general medical physicians.

Easy Way To Get Loan With Bad Credit

Loans for Bad Credit We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on. Bad credit personal loans are an alternative payment solution that helps people with poor credit and bad credit histories access loans and financing to fit. OneMain Financial generally accepts applicants with at least a poor or fair credit score (the exact credit score minimum is not disclosed but for reference, a. Bad credit high income loans are easier to qualify for compared to bad credit low income loans. While it's still a greater risk to loan money to a bad. People with bad credit or no credit history at all may have fewer options when it comes to getting a loan. Even if they're approved, their loan may come with a. How do bad credit loans online work? In a nutshell, when a bank or credit union reviews an application for a borrower with poor credit, they'll either deny it. Compare rates on personal loans for low credit from Bankrate's top picks; What are bad credit loans? How to get a personal loan with bad credit; Alternatives. Securing a loan is easy with great credit Major lenders don't want to back a loan to individuals with poor credit. How to get a loan with bad credit. Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you. Loans for Bad Credit We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on. Bad credit personal loans are an alternative payment solution that helps people with poor credit and bad credit histories access loans and financing to fit. OneMain Financial generally accepts applicants with at least a poor or fair credit score (the exact credit score minimum is not disclosed but for reference, a. Bad credit high income loans are easier to qualify for compared to bad credit low income loans. While it's still a greater risk to loan money to a bad. People with bad credit or no credit history at all may have fewer options when it comes to getting a loan. Even if they're approved, their loan may come with a. How do bad credit loans online work? In a nutshell, when a bank or credit union reviews an application for a borrower with poor credit, they'll either deny it. Compare rates on personal loans for low credit from Bankrate's top picks; What are bad credit loans? How to get a personal loan with bad credit; Alternatives. Securing a loan is easy with great credit Major lenders don't want to back a loan to individuals with poor credit. How to get a loan with bad credit. Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you.

A low credit score should not limit you from getting a loan. Find the best loans for bad credit at the best rates for you. A bad credit loan is a short-term financial fix for consumers who need to borrow money but have a bad credit score and/or poor credit history. Bad credit loans. At Atlas Credit, we regularly provide bad credit loans to our customers. Transparent Process. You'll be fully informed of every detail – the monthly payment. You might find it difficult to get a personal loan with poor credit, because the lender has no security if you fail to make your repayments. So you will have. Having a co-borrower could help improve your chances of getting a loan, especially if you have a poor credit score. Credit card cash advance. A cash advance is. With the new Cash Unlimited® Visa Signature® Credit Card. Introducing Low Cash Mode®. Everyone can have a low cash moment. We're here to help when you do. You can follow these steps to apply for a personal loan with poor credit: Research low-credit-score lenders. Compare rates, terms and fees from multiple. While it can be tough to get a personal loan with bad credit, there are still some options you can explore. Consider credit unions, which often. Quick, no credit check loan up to $ for qualifying existing members. Ashley and I were Greeted in a warm, personalized way and Provided easy access to. Eligible Wells Fargo customers can easily access their FICO ® Credit A low DTI ratio is a good indicator that you have enough income to meet your. Because lenders generally look at borrowers with bad credit as high-risk investments, it can be hard to qualify for a loan with a poor or fair credit score. The best home loan option for you if you have bad credit depends on how low your score is. If your score is below , you probably should look into an FHA loan. To get a personal loan with bad credit, you should ideally have a reliable and sufficient income to make loan payments, as well as a low debt-to-income ratio . Eligible Wells Fargo customers can easily access their FICO ® Credit A low DTI ratio is a good indicator that you have enough income to meet your. The best personal loans for bad credit · Best for people without credit history: Upstart · Best for improving financial literacy: Upgrade · Best for debt. The best home loan option for you if you have bad credit depends on how low your score is. If your score is below , you probably should look into an FHA loan. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required, applying is easy. This can make it difficult for the borrower to qualify for new loans and lines of credit, as lenders are typically wary of borrowers with poor credit histories. A poor credit score should not be a barrier for individuals who need financial support, and many lenders agree. Even if you believe you have “bad” credit. The best personal loans for bad credit · Best for people without credit history: Upstart · Best for improving financial literacy: Upgrade · Best for debt.

Borrowing Against Roth Ira

IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans. A loan from an IRA or IRA-based plan would result in a prohibited. With traditional and Roth IRAs, you can withdraw from your account at any time for any reason. Potential drawbacks to withdrawals include: For (k) and. If you've met the five-year holding requirement, you can withdraw money from a Roth IRA with no taxes or penalties. Remember that unlike a Traditional IRA, with. Your employer may allow you to borrow money or request emergency withdrawals from your (b) plan under certain conditions. Keep in mind that each (b). Unlike Traditional IRAs, you aren't required to take minimum distributions (RMDs) from a Roth IRA when you reach a certain age. If you don't need the money. It is possible to withdraw from your Roth IRA to buy a house. However Lending services provided by Rocket Mortgage, LLC, a subsidiary of Rocket. No, you cannot borrow money directly from your IRA. Unlike some employer-sponsored retirement plans, IRAs don't allow for loans. IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans. A loan from an IRA or IRA-based plan would result in a prohibited. Unlike a k, you can't technically borrow against a Traditional or Roth IRA without avoiding an early withdrawal tax. IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans. A loan from an IRA or IRA-based plan would result in a prohibited. With traditional and Roth IRAs, you can withdraw from your account at any time for any reason. Potential drawbacks to withdrawals include: For (k) and. If you've met the five-year holding requirement, you can withdraw money from a Roth IRA with no taxes or penalties. Remember that unlike a Traditional IRA, with. Your employer may allow you to borrow money or request emergency withdrawals from your (b) plan under certain conditions. Keep in mind that each (b). Unlike Traditional IRAs, you aren't required to take minimum distributions (RMDs) from a Roth IRA when you reach a certain age. If you don't need the money. It is possible to withdraw from your Roth IRA to buy a house. However Lending services provided by Rocket Mortgage, LLC, a subsidiary of Rocket. No, you cannot borrow money directly from your IRA. Unlike some employer-sponsored retirement plans, IRAs don't allow for loans. IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans. A loan from an IRA or IRA-based plan would result in a prohibited. Unlike a k, you can't technically borrow against a Traditional or Roth IRA without avoiding an early withdrawal tax.

As much as you may need the money now, by taking a withdrawal or borrowing from your retirement account, you're interrupting the potential for the funds to grow. Neither Roth nor traditional IRAs allow you to take loans, but you can access money from an IRA for a day period through a "tax-free rollover" if you put the. Can I borrow from my Roth (b) account? No. Can I take a withdrawal from Yes from other Roth plan accounts, but not Roth IRA. Yes from Roth plan. * You will have to pay ordinary income taxes on a withdrawal amount (unless from your Roth account), and a 10% early withdrawal penalty if you take the. The IRS does not permit loans from Roth IRAs. You can withdraw from your Roth IRA, however. Withdrawals of contributions are non-taxable. However, most Roth. The great thing about Roth IRAs is that there's less risk of penalty for withdrawing from these funds before you reach retirement age. When certain conditions. You can also borrow from your (k). Penalty-free Withdrawals from Individual Retirement Plans. Normally, if you withdraw money from a traditional or Roth IRA. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. Roth IRA · Roth vs Traditional · Withdrawal Rules · Contribution Limits. Rollover Borrow against your portfolio to buy securities or for quick access to. If you have a Roth IRA, you are always permitted to withdraw the money you've invested (your "contributions") without incurring penalties; penalties would apply. Unlike a k, you cannot borrow against an IRA. However, you can invest with your IRA into real estate as long as you have the correct self directed IRA setup. Internal Revenue Service (IRS) rules do not allow you to borrow from a Roth individual retirement account (Roth IRA) in the same way that you. With a non-recourse loan, the rental income from the property is deposited into your Self-Directed IRA, helping to repay the loan and build equity within your. Internal Revenue Service (IRS) rules do not allow you to borrow from a Roth individual retirement account (Roth IRA) in the same way that you. Neither Roth nor traditional IRAs allow you to take loans, but you can access money from an IRA for a day period through a "tax-free rollover" if you put the. Can you borrow money from your IRA? Generally speaking, no, you can't take out a loan from either a traditional or Roth IRA. But there are ways to get. When you apply for the loan, it's made directly to the IRA (not to you). IRS rules prohibit the use of IRA loan funds for certain investments, such as life. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. First, the money must stay in the Roth IRA for five years after the year you make the conversion. The five-year conversion rule is also separate from the five-.

Redge Portable Gym Machine Reviews

The length of the bar is 40 inches (can be split in half). In short, it is a "Portable all-in-one gym machine". At the office during lunch. Redge Fit Lower Body Workout (At Home). Gymless Fitness•12K views Garage Gym Reviews•K views · Go to channel · I Woke Up At Redge Fitness Reviews. Discover videos related to Redge Fitness Reviews lb Redge Portable Gym Machine Get yours for 70% OFF #redgefit #fitness. 20% OFF Your Redge Portable Gym! March 8 5 Reasons to Get The Redge Gym Machine. February 17, - 6 months ago. We have reviews of the best exercise equipment and fitness gear: treadmills, dumbbells, yoga mats, jump ropes, pull-up bars, and more. It's compact and easy to assemble, making it perfect for small spaces. Whether you live in an apartment or have a limited workout area, this is the ideal choice. Just Awesome! Working with Redge fit guys this since last year and have lost 25lbs!! Their training programs are awesome and the follow along workout videos. workout by simply adding in an extra set of Redge Bands. Each band adds up to 30 lbs of resistance! Custom cut made to fit your Redge portable gym machine. Any workout you do at the gym. you can do with just this one bar. Literally squats, shoulder press, bicep curls, chest flies, hundreds of. The length of the bar is 40 inches (can be split in half). In short, it is a "Portable all-in-one gym machine". At the office during lunch. Redge Fit Lower Body Workout (At Home). Gymless Fitness•12K views Garage Gym Reviews•K views · Go to channel · I Woke Up At Redge Fitness Reviews. Discover videos related to Redge Fitness Reviews lb Redge Portable Gym Machine Get yours for 70% OFF #redgefit #fitness. 20% OFF Your Redge Portable Gym! March 8 5 Reasons to Get The Redge Gym Machine. February 17, - 6 months ago. We have reviews of the best exercise equipment and fitness gear: treadmills, dumbbells, yoga mats, jump ropes, pull-up bars, and more. It's compact and easy to assemble, making it perfect for small spaces. Whether you live in an apartment or have a limited workout area, this is the ideal choice. Just Awesome! Working with Redge fit guys this since last year and have lost 25lbs!! Their training programs are awesome and the follow along workout videos. workout by simply adding in an extra set of Redge Bands. Each band adds up to 30 lbs of resistance! Custom cut made to fit your Redge portable gym machine. Any workout you do at the gym. you can do with just this one bar. Literally squats, shoulder press, bicep curls, chest flies, hundreds of.

The BEST Way to Use Cardio to Lose Fat (Based on Science) · The THINNEST Dual-Stack Functional Trainer for Home Gyms Reviewed! · Fit! · Portable. Redge Fit provides portable gym equipment that will fit in any space and will cost you one tenth the amount. Save unimaginable amount on inexpensive home. Redge What is Redge Portable Gym: Redge Redge Portable Gym Machine getredge. views · 1 year ago more. Trendy Product Reviews. Comments85 ; Redge Fit - Redge Home Gym Review. Marvin Martelly · 22K views ; Redge Fit Full Body Workout (Follow Along). Gymless Fitness · 46K. The handles and straps are comfortable to use, and the overall construction feels reliable for regular workouts. Overall, the Redge Fit portable full body home. CLICK TO BUY: itimas.ru What Is The Redge Portable Gym Machine Redge Fit - Redge Home Gym Review. Marvin Martelly•22K. Overall, despite having one or two minor flaws, the Redge Fit is a very strong and versatile piece of equipment that is ideal if you are looking to build muscle. Redge Portable All-In-One Gym Machine · Each band provides 30Lb of resistance · 4 Bands provide a total of Lb of resistance · It weighs only Lb and can fit. Redge fit exercises · Pilates Barre Workout · Pilates SIMULATE GYM MACHINE: INNSTAR Bench Press Bands Kit is a prefect replacement of gym. Pilates Bar Kit With Resistance Bands Portable Home Gym Workout Equipment Perfect Stretched Fusion Exercise Bar And Bands. Redge Portable Gym Machine · Redge Massage Gun · Redge Fit Rebound Ab Roller Reviews. REDGE FIT. Headquartered in Toronto, Canada and is wholly owned by. This compact and travel-friendly gym machine allows you to get a full-body workout wherever you go. The Redge Portable Gym Machine comes with extra resistance. Redge Fit Reviews The Redge Fit Bar is a functional gym machine that consists of a heavy-duty bar fitted with durable and adjustable resistance bands attached. Redge fit exercises · Pilates Barre Workout · Pilates SIMULATE GYM MACHINE: INNSTAR Bench Press Bands Kit is a prefect replacement of gym. Ridgefit Reviews · Foldable Gym Equipment · Gym Equipment · Best at Home Redge Portable Gym Machine Get yours for 70% OFF #redgefit. people have already reviewed Redge Fit. Read about their experiences and share your own! | Read Reviews out of Worlds #1 Portable Gym Machine Workout App & Nutrition Coach Over 10K Reviews · Happy day Did you know? · Who needs a gym when you have a door. Reviewing the FIT! Home Gym. I was eyeing this over a year ago when I saw it first launch but wasn't sure if it was something I'd use and. Does it job for the price. The foot straps could be a little bit bigger but works well. Great for cardio. See more reviews. Redge Fit provides portable gym equipment that will fit in any space and will cost you one tenth the amount. Save unimaginable amount on inexpensive home.

How Do I Deposit Money Into My Account

You can set up Direct Deposit, visit a local Regions branch, use Mobile Deposit with your mobile device, use a DepositSmart ATM® (available at certain Regions. Use Chase Secure Banking to deposit money to your account in person, on your phone, or by direct deposit. Learn more about all the ways to add money to your. Wells Fargo ATMs accept cash deposits but you would need an acct with them. Go into a branch and setup a checking out savings account it should only take a few. Add value to your MarquetteCASH Account using a credit or debit card. These funds are added instantly and are available for use immediately. To Account. MUID. Bring your cash, deposit slip, and ID to the bank teller and tell them you want to make a deposit. They'll confirm the amount and deposit it into your account. From the mobile app: · Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to. Deposit money into your account at a Capital One location near you. Mobile deposit. Deposit a check into your account anytime, almost anywhere with mobile. Sign into the ATM: Follow the prompts by inserting your card, choose the cash deposit option and specify the bank account you'd like to deposit your funds into. Deposit at an ATM Select ATMs accept deposits of up to 30 bills and 10 checks per deposit. All you need is your USAA Federal Savings Bank ATM or debit card —. You can set up Direct Deposit, visit a local Regions branch, use Mobile Deposit with your mobile device, use a DepositSmart ATM® (available at certain Regions. Use Chase Secure Banking to deposit money to your account in person, on your phone, or by direct deposit. Learn more about all the ways to add money to your. Wells Fargo ATMs accept cash deposits but you would need an acct with them. Go into a branch and setup a checking out savings account it should only take a few. Add value to your MarquetteCASH Account using a credit or debit card. These funds are added instantly and are available for use immediately. To Account. MUID. Bring your cash, deposit slip, and ID to the bank teller and tell them you want to make a deposit. They'll confirm the amount and deposit it into your account. From the mobile app: · Use your fingerprint to securely log in. · Select Pay & Transfer then Transfer between my accounts. · Select the account you want to. Deposit money into your account at a Capital One location near you. Mobile deposit. Deposit a check into your account anytime, almost anywhere with mobile. Sign into the ATM: Follow the prompts by inserting your card, choose the cash deposit option and specify the bank account you'd like to deposit your funds into. Deposit at an ATM Select ATMs accept deposits of up to 30 bills and 10 checks per deposit. All you need is your USAA Federal Savings Bank ATM or debit card —.

Make cash or check deposits by ATM, in-person or by using the Capital One online mobile app.

Many banks offer customers an external transfer feature on their websites to click on in order to send money to an account at another financial institution. Join the 8 out of 10 taxpayers who get their refunds via direct deposit. You can split your refund into one, two or three financial accounts and buy savings. Wells Fargo ATMs accept cash deposits but you would need an acct with them. Go into a branch and setup a checking out savings account it should only take a few. Depositing money into an account · Set up payroll direct to an eligible Fidelity accountLog In Required · Send money to or from a bank account with an electronic. M&T Bank offers several options to make a deposit: at a bank branch, at an ATM, through mobile deposits, or direct deposit funds into your account. For cash or cheque deposits, you need to submit a deposit slip provided at the bank. You have to fill out this slip by providing your name and account number. Can I deposit cash into my Found account? · Tap Add Money in your Found mobile app. · Choose Cash deposit from the menu. · Use the map to find a convenient. Discover how Fifth Third Bank members can make deposits into their bank accounts in easy, secure, and convenient ways Safely deposit your money directly into. How do I add money to my PayPal balance from my bank? · Go to your Wallet. · Click Transfer Money. · Choose "Add money from your bank or debit card.' Enter the. Enter who will get the money. To send directly to their bank account you'll need to have their name and contact details on hand. Pick your payment option. You can deposit cash into your Chime Account at over retail locations with our cash deposit partners. Ask the cashier to make a. Bring your cash, deposit slip, and ID to the bank teller and tell them you want to make a deposit. They'll confirm the amount and deposit it into your account. For instance, making a cash deposit means that your money is available in your account right away. If you need to make a deposit, but can't get to a bank. It's really easy to do - simply select your bank from the drop-down menu and check whether cash deposits are supported. You can also find your nearest Post. When will my Direct Deposit Funds be posted to my account? Why do some employees on Direct Deposit have their money earlier than others? How will I know. You can deposit cash in any branch of the bank in which you have account for deposit in your account. Some banks allow deposit of cash in. Use at off-campus Mason Merchants · Family members can add Mason Money to your account via Visa/Mastercard or checks · No minimal balance and maintenance fee. The only way to get funds into that account is through your credit/debit sales. Judy T Shumway. Reply. Zelle®: To send money in minutes with Zelle®, you must have an eligible U.S. Bank account and have a mobile number registered in your online and mobile banking. When will my deposit be credited to my account?Expand. If you make your money. Can I use my mobile device to make a deposit?Expand. Yes. With Wells.

Stocks For The Next Decade

Five fundamental factors drive long-term stock returns: sales growth, changes in the share count (buybacks), margin growth, changes in the P/E multiple. Bob Doll, vice chairman and chief fundamental equity strategist at BlackRock, is forecasting annualized U.S. stock market returns of close to 8% for the. Growth stocks · Stock funds · Bond funds · Dividend stocks · Value stocks · Target-date funds · Real estate · Small-cap stocks. Best Growth Stocks for the Next Decade. · Humacyte · SoundHound AI · Nvidia · Botz · Recursion Pharmaceuticals · Crowstrike · AVGO · Microsoft. Five fundamental factors drive long-term stock returns: sales growth, changes in the share count (buybacks), margin growth, changes in the P/E multiple. market is expected to expand in the next decade across all the Global Artificial Intelligence (AI) In Healthcare Market Size Is Anticipated To Reach. Given the high value of today's stock market and an expectation of slower economic growth in the future, the OACT could adjust its stock return projections in. 3 A high P/E ratio suggests investors expect strong future growth but could signal an overvalued stock. Conversely, a low P/E ratio could mean the stock is. Pundits keep saying the decade-plus run of outperformance for US stocks last decade is highly unlikely to be repeated over the next decade. We are. Five fundamental factors drive long-term stock returns: sales growth, changes in the share count (buybacks), margin growth, changes in the P/E multiple. Bob Doll, vice chairman and chief fundamental equity strategist at BlackRock, is forecasting annualized U.S. stock market returns of close to 8% for the. Growth stocks · Stock funds · Bond funds · Dividend stocks · Value stocks · Target-date funds · Real estate · Small-cap stocks. Best Growth Stocks for the Next Decade. · Humacyte · SoundHound AI · Nvidia · Botz · Recursion Pharmaceuticals · Crowstrike · AVGO · Microsoft. Five fundamental factors drive long-term stock returns: sales growth, changes in the share count (buybacks), margin growth, changes in the P/E multiple. market is expected to expand in the next decade across all the Global Artificial Intelligence (AI) In Healthcare Market Size Is Anticipated To Reach. Given the high value of today's stock market and an expectation of slower economic growth in the future, the OACT could adjust its stock return projections in. 3 A high P/E ratio suggests investors expect strong future growth but could signal an overvalued stock. Conversely, a low P/E ratio could mean the stock is. Pundits keep saying the decade-plus run of outperformance for US stocks last decade is highly unlikely to be repeated over the next decade. We are.

Discover real-time NextDecade Corporation Common Stock (NEXT) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Stock analysis for NextDecade Corp (NEXT:NASDAQ CM) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Based on 3 Wall Street analysts offering 12 month price targets for NextDecade in the last 3 months. The average price target is $ with a high forecast of. Discover real-time NextDecade Corporation Common Stock (NEXT) stock prices, quotes, historical data, news, and Insights for informed trading and investment. 2 Unstoppable Growth Stocks to Buy and Hold for the Next Decade · Growth stock to buy No. 1: Eli Lilly · Growth stock to buy No. 2: Tesla · Should you invest. NextDecade Corp. NEXT. 7 Great Stocks To Buy and Hold · #1) Enterprise Products Partners (EPD) · #2) Brookfield Corporation (BN) · #3) MicroStrategy (MSTR) · #4) HDFC Bank (HDB) · #5). View NextDecade Corp. NEXT stock quote prices, financial information, real-time forecasts, and company news from CNN. What are the Top 5 Investments of the Last Decade? · Netflix - NASDAQ, % · Ashtead Group - LSE, 43% · MarketAxess Holdings - NASDAQ, % · Domino's. Based on 3 Wall Street analysts offering 12 month price targets for NextDecade in the last 3 months. The average price target is $ with a high forecast of. Five fundamental factors drive long-term stock returns: sales growth, changes in the share count (buybacks), margin growth, changes in the P/E multiple. Growth stocks · Stock funds · Bond funds · Dividend stocks · Value stocks · Target-date funds · Real estate · Small-cap stocks. NextDecade Corporation is an energy company. The Company is engaged in construction and development activities related to the liquefaction and sale of liquefied. First, past and future long-run trends in the capital market may imply a decline in the equity premium. Second, the current valuation of stocks, which is. NextDecade Corporation is an energy company. The Company is engaged in construction and development activities related to the liquefaction and sale of liquefied. 6 Things to Look for and Consider in the Near Future · Capital efficient businesses with high returns on capital · Value vs Growth Stocks · Cash · Hedges · The value. Pizza dough isn't the only thing that's been rising over at Domino's. The share price has been increasing impressively over the last 10 years. An investment of. NEXT | Complete NextDecade Corp. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. First, past and future long-run trends in the capital market may imply a decline in the equity premium. Second, the current valuation of stocks, which is. Complete NextDecade Corp. stock information by Barron's. View real-time NEXT stock price and news, along with industry-best analysis.

How To Calculate Monthly Retirement Income

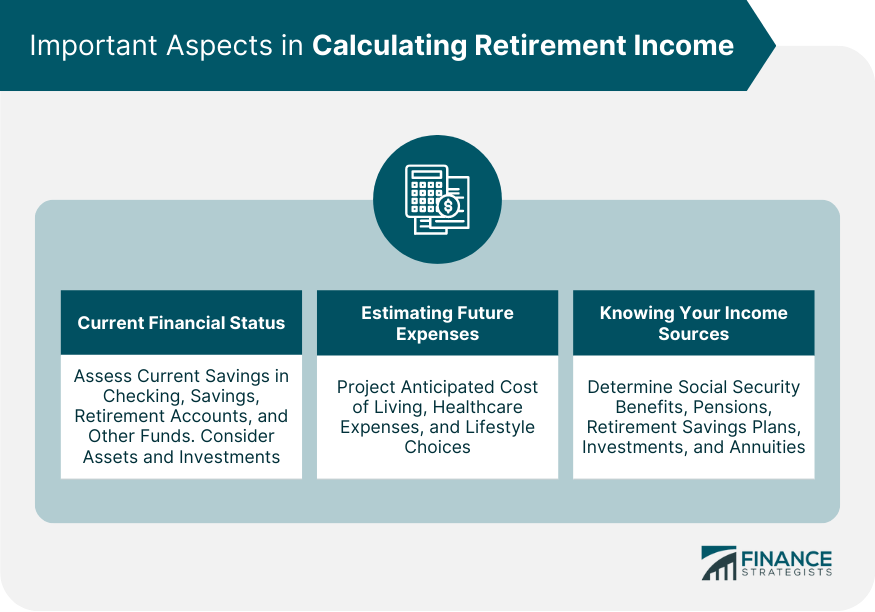

Our retirement income calculator is designed to consider various financial factors to help you estimate your income after you retire. Use this calculator to determine how much monthly income your retirement savings may provide you in your retirement. Monthly budget in retirement. If you're unsure, start with the recommended 70% of your projected income at retirement age (67). 70% of pre-retirement income. RETIREMENT CALCULATOR · Send my results by email · About you · Retirement goal · Accumulated retirement savings · Other retirement income · For your retirement, you. Plug in some information about yourself and your retirement plans, and we'll show you what you need to save to make reality meet your expectations. So if you retire with 29 years of credit, your pension will provide roughly 58% of your average best five years' salary at retirement. Keep in mind this is very. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. Estimate your benefit amount, determine when to apply, and explore other While Social Security earnings are calculated the same way for most jobs. To determine how much money you'll need when you retire, enter your desired retirement age and the number of years you expect to draw on your retirement income. Our retirement income calculator is designed to consider various financial factors to help you estimate your income after you retire. Use this calculator to determine how much monthly income your retirement savings may provide you in your retirement. Monthly budget in retirement. If you're unsure, start with the recommended 70% of your projected income at retirement age (67). 70% of pre-retirement income. RETIREMENT CALCULATOR · Send my results by email · About you · Retirement goal · Accumulated retirement savings · Other retirement income · For your retirement, you. Plug in some information about yourself and your retirement plans, and we'll show you what you need to save to make reality meet your expectations. So if you retire with 29 years of credit, your pension will provide roughly 58% of your average best five years' salary at retirement. Keep in mind this is very. Free calculators that help with retirement planning with inflation, social security, life expectancy, and many more factors being taken into account. Estimate your benefit amount, determine when to apply, and explore other While Social Security earnings are calculated the same way for most jobs. To determine how much money you'll need when you retire, enter your desired retirement age and the number of years you expect to draw on your retirement income.

Social Security's benefit calculators give you a preview of your future payments. How much Social Security income you may receive when you retire will depend on. Retirement Income Calculator. Use this calculator to determine how much monthly income your retirement savings may provide you in your retirement. Your annual. Use this calculator to estimate your future monthly income generated by savings and what that means in today's dollars. A retirement savings calculator is a handy planning tool that lets you see how much you might end up with during retirement based on how much you save monthly. Are you saving enough for retirement? SmartAsset's award-winning calculator can help you determine exactly how much you need to save to retire. 1. How Much Income Will You Need In Retirement? 2. How Much Retirement Income Will You Receive from Social Security and Pensions? Monthly Social Security. Calculating the amount of money you'll need for retirement can be confusing income is more than this amount. It is fully eliminated once you have. View your retirement savings balance and calculate your withdrawals for each year. Social security is calculated on a sliding scale based on your income. Use this Retirement Income calculator to determine how much monthly income your retirement savings may provide you in retirement. The simplified tool for simulating retirement income. Have you got plans for retirement? Calculating how much you need to save for retirement has never been. This calculator illustrates an annuitization approach to estimate the monthly lifetime income streams based on both the participant's current account balance. Use this calculator to estimate how much income you may have in retirement and learn what you can do today to put yourself on track for your long-term. Calculate your future monthly retirement income in less than a minute. My Personal Pension. Estimate your monthly lifetime income payment in under a minute. Retirement Budget Calculator. Compare your income and expenses to see if you're ahead or come up short. Calculate. $ Payment period for your current salary and other income. Per year, Per month, Every 2 weeks, Per week. Enter your gross income, including your salary for the. One rule of thumb is that you'll need 70% of your annual pre-retirement income to live comfortably. That might be enough if you've paid off your mortgage and. Showing participants their retirement plan account balance as level monthly payments for their lifetime will help them assess their retirement readiness and. What's a good monthly retirement income for me? If you retire at 64 savings and estimated future contributions may help to meet estimated income in retirement. You would be able to make Monthly withdrawals in the amount of $ and one final withdrawal of $ This calculator assumes that periodic. Retirement income calculator. Use this calculator to find out how long the Use this calculator to see how adding to the amount you save can affect the amount.

How To Promote Youtube Channels

1. Choose Google-friendly keywords. A great YouTube channel starts with great SEO. And great SEO starts with understanding what users are. YouTube marketing is the practice of using video content on YouTube to promote a brand or product. It includes a mix of creating and promoting YouTube videos on. We'll explore 10 proven hacks to promote your channel and attract more subscribers. From understanding the YouTube algorithm to creating engaging content and. If you want to make the channel using your personal account, sign into YouTube, click your profile picture in the top right corner, and then click the “Create a. Build video engagement and grow your channel · Step 1: Set up account · Step 2: Select your video · Step 3: Set up targeting · Step 4: Choose your budget. If you want to promote your YouTube channel, you need to do keyword research. There's an entire science of doing keyword research. Use tools such as SEMRush or. You could try pre roll ads, or expand your audience base by doing some collab videos. Do some giveaways. Ask people to subscribe to your channel, and all your. Social Media. You can leverage various social media platforms like Instagram, Facebook, Snapchat to drive organic traffic to your YouTube channel. Posting. 30 smart ways to promote your YouTube channel · 1. Choose Google-friendly keywords · 2. Use concise, descriptive video titles · 3. Create custom thumbnails · 4. 1. Choose Google-friendly keywords. A great YouTube channel starts with great SEO. And great SEO starts with understanding what users are. YouTube marketing is the practice of using video content on YouTube to promote a brand or product. It includes a mix of creating and promoting YouTube videos on. We'll explore 10 proven hacks to promote your channel and attract more subscribers. From understanding the YouTube algorithm to creating engaging content and. If you want to make the channel using your personal account, sign into YouTube, click your profile picture in the top right corner, and then click the “Create a. Build video engagement and grow your channel · Step 1: Set up account · Step 2: Select your video · Step 3: Set up targeting · Step 4: Choose your budget. If you want to promote your YouTube channel, you need to do keyword research. There's an entire science of doing keyword research. Use tools such as SEMRush or. You could try pre roll ads, or expand your audience base by doing some collab videos. Do some giveaways. Ask people to subscribe to your channel, and all your. Social Media. You can leverage various social media platforms like Instagram, Facebook, Snapchat to drive organic traffic to your YouTube channel. Posting. 30 smart ways to promote your YouTube channel · 1. Choose Google-friendly keywords · 2. Use concise, descriptive video titles · 3. Create custom thumbnails · 4.

Create a good channel that constantly puts out quality content that people want, you'll get the attention and eyeballs you need to drive customer acquisition. Choose Your Video. Select the content you want to promote from your channel. 1. In this article, we will discuss some effective ways to promote a YouTube channel and grow your audience. This guide is to explain the different options you have when creating Google Ads for YouTube channels. In this way, you can maximize your YouTube marketing. Veefly helps you to promote YouTube Video of your Channel and get you more engagement by promoting it to relevant audiences using Google Ads. Sign Up now! Become a part of the community that your videos are centred around. You can direct followers to your youtube channel. Reddit is also a good. YouTube marketing is the practice of using video content on YouTube to promote a brand or product. It includes a mix of creating and promoting YouTube videos on. How can I promote my YouTube channel fast? Use cross-promotion. Promote your channel and video on radio, TV, various websites, forums and social networks. Let. Use a photo or your brand elements and add some text to lure viewers in — like Hootsuite does on the Hootsuite Labs channel: Current specs are a format. Step 1: Click on Customize Channel to get started. how to create a youtube channel brand account. Step 2: Add a channel profile picture and channel art. These. We've rounded up the most effective ways to promote your YouTube channel. Follow these tips to increase your views and improve the ROI of your YouTube strategy. VRocket can help you promote your YouTube channel using YouTube ads starting at only $ We offer the best price for high-quality,% real YouTube views. You. Check out these 11 tactics for promoting your YouTube channel and building your viewer audience and engagement. 1. Post snippets of videos. Once you have finished creating a new video for YouTube, go a step further by creating a condensed version for other sites. AIR Media-Tech will share paid and organic proven ways to promote a YouTube channel, that will help you reach out to all of these people! Traditional marketing still works. Business cards are an easy and effective way to market your YouTube channel. For best results, every card should include your. Grow your business with YouTube Ads · Reach potential customers where they're watching. · Get more eyes on your channel and results for your business · Reach your. Each channels videos content gets custom video optimization following youtube recommended steps. You get more youtube subscribers (the right way!). And because. How Prodvigate works · Setup. Add your YouTube channel, choose your weekly budget and targeting information (countries, gender, age, interests) · Payment. Choose. You can either group existing videos from your channel together under a common theme or combine vids from other relevant partners or influencers—demonstrating.

Dollar Rupee Exchange Rate Today

US Dollar/Indian Rupee FX Spot Rate INR=:Exchange · Open · Prev Close · Day High · Day Low Get latest 1 Dollar to INR rates, Dollar to Rupee conversion rates, USD INR Forex rates, USD INR rate forecast, Dollar vs rupee historical rates. Download Our Currency Converter App ; 1 INR, USD ; 5 INR, USD ; 10 INR, USD ; 20 INR, USD. The exchange value of 1 USD in Indian Rupee is INR as on Aug How to convert 1 USD to INR with Paytm online. You can convert 1 United States Dollar to. Convert US Dollar to Indian Rupee ; 1 USD, INR ; 5 USD, INR ; 10 USD, INR ; 25 USD, 2, INR. 1 USD = INR · SELL 1 USD @ INR · BUY 1 USD @ INR. USD to INR - Today's Best US Dollar to Rupee Exchange Rate ; Remitly Exchange Rate · Reviews · ₹ · $ ; Abound Exchange Rate. 19 Reviews · ₹ The change for INR to USD was The performance of INR to USD in the last 90 days saw a 90 day high of and a 90 day low of This means. Current exchange rate US DOLLAR (USD) to INDIAN RUPEE (INR) including currency converter, buying & selling rate and historical conversion chart. US Dollar/Indian Rupee FX Spot Rate INR=:Exchange · Open · Prev Close · Day High · Day Low Get latest 1 Dollar to INR rates, Dollar to Rupee conversion rates, USD INR Forex rates, USD INR rate forecast, Dollar vs rupee historical rates. Download Our Currency Converter App ; 1 INR, USD ; 5 INR, USD ; 10 INR, USD ; 20 INR, USD. The exchange value of 1 USD in Indian Rupee is INR as on Aug How to convert 1 USD to INR with Paytm online. You can convert 1 United States Dollar to. Convert US Dollar to Indian Rupee ; 1 USD, INR ; 5 USD, INR ; 10 USD, INR ; 25 USD, 2, INR. 1 USD = INR · SELL 1 USD @ INR · BUY 1 USD @ INR. USD to INR - Today's Best US Dollar to Rupee Exchange Rate ; Remitly Exchange Rate · Reviews · ₹ · $ ; Abound Exchange Rate. 19 Reviews · ₹ The change for INR to USD was The performance of INR to USD in the last 90 days saw a 90 day high of and a 90 day low of This means. Current exchange rate US DOLLAR (USD) to INDIAN RUPEE (INR) including currency converter, buying & selling rate and historical conversion chart.

As per today's exchange rate i.e. Saturday 31/08/, 1 US Dollar is equals to Indian Rupees. Change in USD rate from previous day is %. In case you. Currently, 1 USD stands at approximately INR How Can I Convert US Dollar to INR in India. Some common ways to exchange US Dollar currency with INR in. Australian Dollar · BRL Brazilian Real · CHF Swiss Franc · CNY Chinese Yuan Renminbi · EUR Euro · GBP British Pound · HKD Hong Kong Dollar · INR Indian Rupee. Find the current US Dollar Indian Rupee rate and access to our USD INR Exchange Rates Table · US Dollar Index Futures · Currency Futures · Currency. Today itimas.ru 01/09/, for 1 US Dollar you get Indian Rupees. Change in USD to INR rate from previous day is %. Moreover, we have also added. Check today's US Dollar to Indian Rupee exchange rate with Western Union's currency converter. Send USD and your receiver will get INR in minutes. USD to INR Selling Rate Today In India ; Mumbai, ₹ ; New Delhi, ₹ ; Chennai, ₹ ; Bangalore, ₹ The exchange rate for US dollar to Indian rupees is currently today, reflecting a % change since yesterday. Over the past week, the value of US. As on 31 Aug , the Conversion Rate for 1 USD (Dollar) is INR (Rupee) today. Will there be a steady exchange rate between USD. 1 USD = INR · SELL 1 USD @ INR · BUY 1 USD @ INR. The current rate of US Dollar to INR is The expected High Low is % For 1 US Dollar, you would receive roughly INR INR 1 = $ INR = $ Current US Dollar to Rupee Exchange Rates (All values were last updated at Rate, Amount, Rate, Amount, Rate, Amount, Rate, Amount, Rate. 1 - , , 1. US Dollar to Indian Rupee Exchange Rate is at a current level of , down from the previous market day and up from one year ago. This is a. Forex Card rates ; United States Dollar (USD), , , , Today's conversion rate of the INR to the US Dollar is 1 INR = Dollars. Within the last 30 days, this conversion rate went high to while it was. Check the currency rates against all the world currencies here. The currency converter below is easy to use and the currency rates are updated frequently. This. US Dollar to Indian Rupee Exchange Rate is at a current level of , down from the previous market day and up from one year ago. Today's conversion rate of the INR to the US Dollar is 1 INR = Dollars. Within the last 30 days, this conversion rate went high to while it was. Record forex reserves to boost economy, promote domestic trade: Industry · India's fintech industry received record $31 bn investment in last 10 years: PM Modi. Check the currency rates against all the world currencies here. The currency converter below is easy to use and the currency rates are updated frequently. This.

Venmo Credit Card Processing Fee

Venmo charges a 3% fee if paying someone with a credit card (but not debit card). The recipient of the Venmo payment can have it sent to their. credit card, debit card, PayPal, Venmo or Amazon Pay. Our payment processing vendor, Paymentus, will charge a convenience fee of $ per transaction. Pay. Each transaction is subject to a seller fee of % of the payment plus $ Therefore, if someone pays your business USD, you will receive 98 USD. This. Use your checking or savings account to make a payment. You must have an online profile to pay your bill online. Pay your bill with a credit/debit card. ¹ No ACH fees. Opt to pay credit card processing fees or charge back to customers. Finli testimonial 4. 49 per transaction for cards and third party digital wallets. An additional 1% fee applies to transactions presented in any non-USD currency. An additional 1%. There is a 3% fee for sending money using a linked credit card. Earn up to 3% cash back on eligible purchases with the Venmo Credit Card. There's no annual fee2, no limit to the cash back you can earn, and no impact to. Get paid faster with Venmo for Business. Accept payments in shops, apps & online. Empower your small business with multiple payment options & no hidden. Venmo charges a 3% fee if paying someone with a credit card (but not debit card). The recipient of the Venmo payment can have it sent to their. credit card, debit card, PayPal, Venmo or Amazon Pay. Our payment processing vendor, Paymentus, will charge a convenience fee of $ per transaction. Pay. Each transaction is subject to a seller fee of % of the payment plus $ Therefore, if someone pays your business USD, you will receive 98 USD. This. Use your checking or savings account to make a payment. You must have an online profile to pay your bill online. Pay your bill with a credit/debit card. ¹ No ACH fees. Opt to pay credit card processing fees or charge back to customers. Finli testimonial 4. 49 per transaction for cards and third party digital wallets. An additional 1% fee applies to transactions presented in any non-USD currency. An additional 1%. There is a 3% fee for sending money using a linked credit card. Earn up to 3% cash back on eligible purchases with the Venmo Credit Card. There's no annual fee2, no limit to the cash back you can earn, and no impact to. Get paid faster with Venmo for Business. Accept payments in shops, apps & online. Empower your small business with multiple payment options & no hidden.

Cards. Visa, Mastercard, Discover, American Express. % ; Digital wallets. Apple Pay, PayPal and Venmo. % ; ACH bank payments. Electronic money transfers. Answer: A non-refundable, flat-rate processing fee of $ for residents and $ for businesses, added by the payment processor to cover transaction costs. Online Payment Options · Debit/Credit Cards – Visa, Mastercard, American Express and Discover (Autopay option available) · E-check · Amazon Pay · Apple Pay (Quick. Stripe's processing fee for bank transfers is % + $, capped at a maximum of $ Activating Bank Transfer in your Stripe Account. In Studio Manager's. Unlike other payment processors, Venmo doesn't charge a processing fee if you send or receive money: With a debit card; Through a bank; Or using your Venmo. 5% service fee on regular (non-tipping) credit card transactions. This fee covers both the service provider's costs, as well as the card processing fee they. Itemizing or displaying a credit charge as a surcharge to a client can be illegal depending on the state. However, you can add a markup amount on the invoice. There's no standard credit card fee. Send money from the Amex App or This amount is determined by your Card's rolling day Person-to-Person transaction. Using the app to collect payments from others is free — Venmo makes money by charging a 3% fee if users want to send money to another person using a credit card. Credit Card Surcharges · Watch out for “transaction fees,” “processing fees,” or “convenience fees.” These might be hidden surcharges. · Check the register, the. Minimum Interest. Charge. If you are charged interest, the charge will be no less than $ FEES. Annual Fee. None. Transaction Fees. • Cash Advances. •. Either $ or 5% of the amount of each cash advance, whichever is greater. None. Penalty Fees. Late Payment. Returned Payment. Up to $ But, just like with credit card processing and other online payment processors, there is a fee for merchants: % plus 10 cents per transaction. [Learn. If you choose to use a credit card to fund the payment, Venmo charges a 3% fee on the transaction amount. This fee helps cover the cost of. Venmo vs. PayPal ; Free from bank account; % plus fixed fee if paid with debit or credit card ; Free from bank account or debit card; 3% if paid with credit. The starting credit limit for the Venmo Credit Card is $ or more; everyone who gets approved for this card is guaranteed this limit. However, depending on. Almost every payment processor will charge you a fee to process each transaction or donation. Usually the fee is a percentage of the total transaction plus a. Reach more buyers and drive higher conversion with an online payment solution that processes PayPal, Venmo, credit and debit cards, Apple Pay. %, or such other amount as may be disclosed to you during the transaction. E-check Fees. Sometimes the sender of a payment you receive may use an E. (Venmo does charge fees for processing transactions with a major credit card; a 3% processing fee is added to every transaction paid for using a credit card.).

1 2 3 4 5